The Hidden Costs of Coercion: Why Property Taxes and Government Monopolies Drive Up Prices

A recent exchange online captured a familiar argument:

Nobody wants to pay property taxes—but everybody wants nice roads, clean parks, good schools, and a fire truck that shows up when your house is on fire.

At one level, that observation is obvious. Public services don’t fund themselves. Roads, parks, and emergency services require resources, labor, and coordination.

But that obvious truth sidesteps the real question.

The debate has never been about whether services cost money. The debate is about how those services are funded and delivered—and what happens when government becomes the dominant provider.

Here is the original post that sparked the exchange:

Nobody wants to pay property taxes

But everybody wants nice roads, clean and pretty public parks, nice public schools, and a fire truck that can get to your house in 2 minutes if it’s on fire

Funny how that works

— Amy Nixon (@texasrunnerDFW) February 4, 2026

https://x.com/texasrunnerDFW/status/2018862077042155840

And here was our response at Forge of Freedom:

Nobody denies that roads, parks, schools, and fire protection cost money. Things don’t fund themselves.

But that isn’t the real objection to property taxes.

The problem is that property taxes are collected through threat of force to fund services delivered through government… pic.twitter.com/vLi2KCwGcJ

— Alex Ooley (@forgeoffreedom) February 4, 2026

https://x.com/forgeoffreedom/status/2019061345853874227

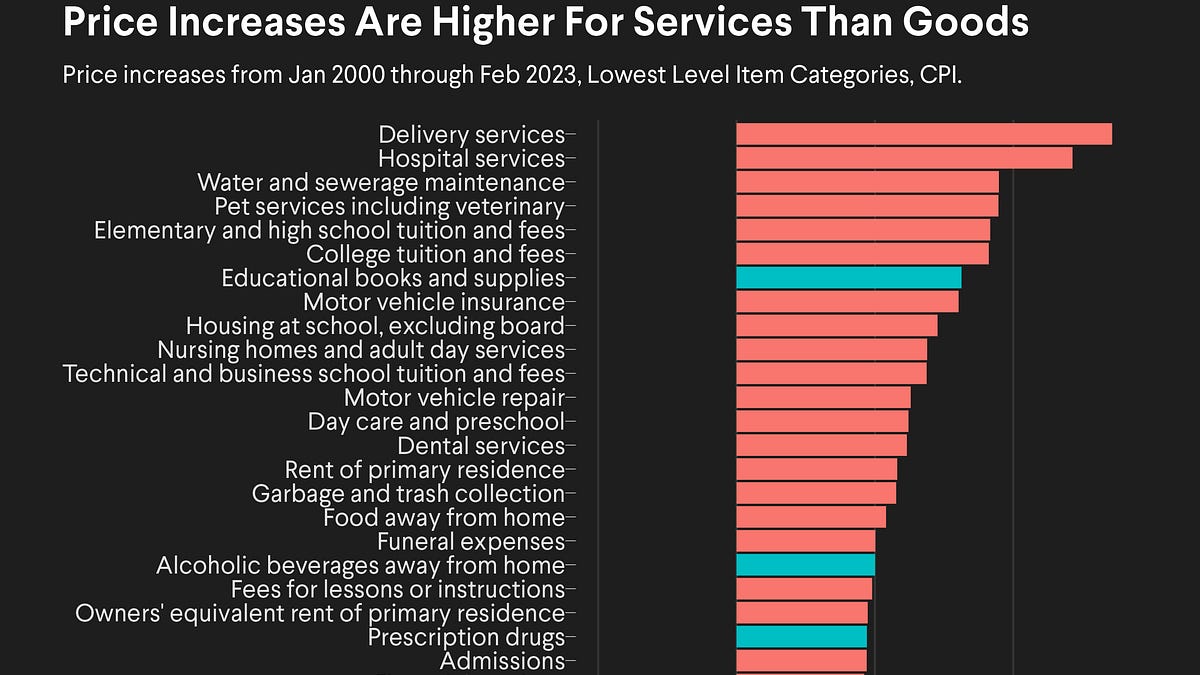

The Chart That Explains the Argument

The following chart, compiled using Bureau of Labor Statistics data and published by AEI, tells a powerful story about the modern American economy:

(Original article: https://www.aei.org/carpe-diem/chart-of-the-day-or-century-8/)

The Two Economies

Look at what has exploded in price since 2000:

- Hospital services

- College tuition

- Medical care

- Childcare

- Housing

Now compare that to goods that have become cheaper or stayed flat:

- TVs

- Software

- Toys

- Cell phone services

- Consumer technology generally

This divide isn’t random.

Sectors with the worst price inflation tend to be those most shaped by government funding, regulation, and bureaucratic control. Meanwhile, industries exposed to competition, innovation, and consumer choice tend to deliver falling prices and rising quality.

Competition forces efficiency. Failure is punished. Innovation is rewarded.

Government systems operate differently. Agencies don’t go bankrupt. Spending often grows regardless of performance. Incentives reward budget expansion more than cost control. Over time, prices rise faster than wages or general inflation.

The chart makes this contrast visible.

Property Taxes and Perpetual Ownership Fees

This brings us back to property taxes.

The objection isn’t that communities shouldn’t fund infrastructure or emergency services. The objection is that property taxes fund those services through coercion while tying that coercion directly to home ownership.

Even after paying off a mortgage, homeowners must continue paying indefinitely. Stop paying, and penalties escalate until government ultimately seizes and sells the property.

In practical terms, you never fully own your home—you rent it forever from the State.

And the money extracted often flows into systems where costs continue rising faster than incomes, just as the chart shows in other government-dominated sectors.

Incentives Matter

Markets aren’t perfect. But markets reward delivering more value at lower cost. Bureaucracies tend to reward spending more money.

When services are funded voluntarily, providers must convince people they are worth paying for. When funding is compulsory, that discipline disappears.

Over time, the difference shows up in price trends—and in taxpayer frustration.

The Real Debate

The question isn’t whether roads, parks, or fire departments should exist.

The real question is whether coercive taxation and government monopolies are the only—or best—way to provide them.

History shows that free people cooperating in competitive systems tend to drive prices down and quality up.

Government-dominated systems, by contrast, tend to drive costs upward—and they do so not through voluntary exchange, but through coercion backed by force.

And that tension sits at the heart of modern debates over taxation, government size, and what ownership and freedom actually mean in a free society.

Further Reading: A Thoughtful Thread Worth Your Time

If this topic interests you, we also recommend checking out an excellent thread that digs further into the relationship between taxation, public services, and the broader questions of government funding and incentives.

It offers additional perspective on how these systems developed and why debates over taxation and public spending continue to generate so much friction today.

You can read the full thread here:

There’s a Reason Why They Call This the “Chart of the Century”

Hospital services up 281%. College tuition up 197%. TVs down 98%.

The same economy delivers abundance through competition and scarcity through regulation.

The difference reveals how policy creates unaffordability.… pic.twitter.com/Bs6q5hqIzm

— Students For Liberty (@sfliberty) February 4, 2026

https://x.com/sfliberty/status/2018837083041800660

Whether you ultimately agree or disagree, it’s a valuable contribution to an ongoing conversation about cost, governance, and what a free society should look like.